South Korea Endoluminal Suturing Device Market Projected to Reach USD 4.1 Million by 2036, at a CAGR of 5.4%.

The demand for endoluminal suturing device in south korea is projected to grow from USD 2.4 million in 2026 to USD 4.1 million by 2036, at a CAGR of 5.4%.

NEWARK, DE, UNITED STATES, January 22, 2026 /EINPresswire.com/ -- The medical technology landscape in South Korea is undergoing a decisive transformation as clinical preference shifts toward organ-preserving, minimally invasive interventions. New industry data reveals that expenditure on endoluminal suturing devices in South Korea is projected to reach USD 2.4 million by the end of 2026. This momentum is expected to carry through the next decade, with financial valuations anticipated to climb to USD 4.1 million by 2036, representing a steady compound annual growth rate (CAGR) of 5.4%.

Driven by a high regional incidence of gastric cancers and a rising demand for metabolic health solutions, endoluminal suturing has moved from a niche secondary option to a cornerstone of modern gastroenterology. These advanced devices allow surgeons to perform complex internal closures without the need for traditional open surgery, significantly reducing patient recovery times and downward pressure on hospital resources.

Strategic Market Insights: Navigating the 2026 Healthcare Shift

The expansion of the South Korean sector is influenced by two primary clinical drivers: early-stage cancer management and the burgeoning bariatric market.

• Early Intervention in Gastric Cancer: Due to genetic factors and local dietary habits, South Korea maintains aggressive national screening programs. Endoscopic Submucosal Dissection (ESD) has become the standard of care for early-stage lesions. However, the large mucosal defects left behind necessitate immediate, secure closure to prevent complications like delayed bleeding or perforation—a task now handled by sophisticated suturing technologies.

• Bariatric and Metabolic Surge: As obesity rates rise, medical professionals are increasingly turning to Endoscopic Sleeve Gastroplasty (ESG). This less invasive alternative to laparoscopic surgery requires robust tools capable of durable tissue approximation, fueling a specialized demand for suturing kits.

Request For Sample Report | Customize Report | Purchase Full Report

https://www.futuremarketinsights.com/reports/sample/rep-gb-31688

Key Industry Statistics (2026–2036)

• Industry Valuation: Projected at USD 2.4 Million in 2026, rising to USD 4.1 Million by 2036.

• Compound Annual Growth Rate (CAGR): Estimated at 5.4% over the ten-year forecast period.

• Leading Product Category: Needle-based Devices, which currently command 62.0% of the market share.

• Primary Application: Bariatric procedures, accounting for 45.0% of industry utilization.

• Top End User: Hospitals, representing the largest stakeholder at 55.0% of total value.

Segment Analysis: Why Needle-Based Systems Lead the Market

The product landscape is currently dominated by needle-based suturing devices, which command 62.0% of the industry. Surgeons favor these systems because they effectively mimic surgical hand-suturing capabilities through a flexible endoscope.

Unlike standard surgical clips, which are limited to small mucosal defects, needle-based systems allow for "full-thickness" bites. This is critical for the secure tissue apposition required in complex bariatric procedures and the management of large perforations. Furthermore, the reloadable nature of these tools improves procedural efficiency, allowing for multiple stitches without the need to remove the endoscope.

Institutional Demand and the Outpatient Trend

Hospitals remain the primary procurement hubs, representing 55.0% of the total market value. Large tertiary care centers in Seoul utilize their significant procurement power to acquire high-cost consumables and automated suturing systems.

However, a secondary trend is emerging in Ambulatory Surgery Centers (ASCs) and specialized clinics. As the healthcare model shifts toward outpatient care, there is an increasing requirement for reliable hemostasis and rapid closure. Suppliers providing single-use, disposable laparoscopic instruments and tailored suturing kits are well-positioned to capture value in these high-throughput environments.

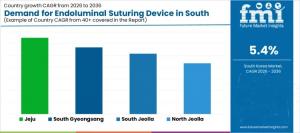

Regional Growth Profiles: Jeju and South Gyeongsang Lead the Pace

The adoption of these technologies is not uniform across the peninsula, with different regions responding to unique demographic and economic pressures.

• Jeju (6.5% CAGR): As a special self-governing province, Jeju is leveraging medical tourism. International patients seeking premium endoscopic bariatric packages are driving the highest growth rate in the country.

• South Gyeongsang (5.7% CAGR): Home to major industrial complexes, this region sees high volumes of stress-related gastric conditions among its workforce, necessitating steady upgrades to university hospital endoscopy departments.

• South Jeolla (5.1% CAGR): An aging population here drives the adoption of endoscopic resection to treat elderly patients who cannot tolerate traditional open surgery.

• North Jeolla (4.3% CAGR): Regional hospitals are strengthening their cancer care capabilities to match the standards of Seoul-based institutions.

Future Outlook: Robotics and Reimbursement

The next frontier for the South Korean market lies in robotic-assisted endoscopy. Domestic innovators like EndoRobotics Co., LTD. are challenging global giants such as Boston Scientific and Medtronic by developing flexible robotic arms that offer greater dexterity and precision. These systems aim to lower the skill barrier for complex procedures, allowing a broader pool of physicians to perform advanced closures.

While the outlook is positive, the industry faces challenges regarding reimbursement. Currently, the government provides coverage for therapeutic closures (such as perforations), but prophylactic or preventative suturing often faces stricter scrutiny. Market leaders are now focusing on generating cost-effectiveness data to demonstrate that the use of premium suturing devices reduces long-term readmission rates and prevents expensive post-operative complications.

Leading Market Participants

The competitive landscape is defined by a mix of established global leaders and agile domestic innovators:

• Boston Scientific Corporation (Leading with a 40% share)

• Medtronic

• Olympus

• Ovesco Endoscopy AG

• EndoRobotics Co., LTD.

Similar Industry Reports

Endoluminal Suturing Device Market

https://www.futuremarketinsights.com/reports/endoluminal-suturing-device-market

South Korea Respiratory Inhaler Devices Market

https://www.futuremarketinsights.com/reports/south-korea-respiratory-inhaler-devices-market

Demand for Endoluminal Suturing Device in UK

https://www.futuremarketinsights.com/reports/united-kingdom-endoluminal-suturing-device-market

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.